October 12, 2023

294 Views

How to Borrow Money from Cash App – Stepwise Process

Cash App finds its name high on the list of the most used digital payment apps. Available to users in the US and the UK, it lets users receive and send money, invest in cryptocurrency like Bitcoin, and even invest in stocks. But did you also know that you can now use the app to borrow a short-term loan? Cash App lets you borrow an amount of up to $200 via the app.

Are you wondering how to borrow money from Cash App? This feature is only available to certain users. You must fulfill certain eligibility parameters of Cash App to avail of the loan. In this post, we will go through every aspect of taking a loan via this app.

How to Borrow Money From Cash App on Your Mobile?

The Borrow feature of the Cash App is very easy to use. If you can see the word ‘Borrow’ written within the app, it means you can avail of the loan. Here’s how to borrow money from Cash App on Android.

- Access the Cash App by opening it up on your mobile phone.

- Now, find the word ‘Borrow.’ To locate it, look at the Banking screen or the home screen of the application.

- If you see ‘Borrow’ written, you can take the loan.

- If you cannot see the ‘Borrow’ option, it means that you are not eligible to avail of the loan.

- To take the loan, touch ‘Unlock.’

- Cash App will present you with a loan amount ranging from $20 to $200.

- Decide on a specific amount according to your requirements and enter it.

- Review the Cash App loan agreement and accept it.

That’s all you need to do to take a loan on the Cash App. If you are wondering how to borrow money from Cash App on iPhone, the procedure remains the same.

Features of the Cash App Borrow Feature

If you have availed of the loan, you must be aware of its features. It will help you learn just how the Borrow feature works. You will also learn what you should do to not default on the loan.

- You can only borrow an amount falling in the range between $20 and $200. There is no way to borrow an amount lower or more than this range.

- Cash App users who are eligible for the loan should use it for household or personal purposes only.

- Once you take the loan, you should pay the loan amount in addition to the 5% interest rate to the Cash App. This amount is to be repaid within a month or a 4-week period.

- Repayment of the loan can be done by making auto payments. Alternatively, you can set up auto payments through the Cash App.

- If you are not able to make the payments, you’ll need to pay an extra 1.25% late fee. This fee is added to your loan amount every week that you default on the payment.

Why Are You Unable to Borrow Money from the Cash App

If you don’t see the ‘Borrow’ option on your Cash App, it means that you are not eligible for the loan. This may be due to the following reasons.

- You have a negative balance on your Cash App. It means that you don’t have enough balance to avail of the loan.

- You have not verified yourself on the Cash App. To verify, you must submit documents like your Social Security Number, birth date, and some other documents that Cash App requests.

- Your credit score is poor. Due to this, Cash App cannot give you the loan.

- You currently reside in a place in the US or the UK where the Borrow feature is not available on Cash App.

- Your Cash App is not updated. A non-updated app will make you unable to access new features like that of the Borrow.

Concluding Words

It’s easy to use the Borrow functionality of the Cash App and get money for urgent matters quickly. But you need to ensure that you give back the amount within the deadline. Also, ensure to verify your account on the app before getting a loan.

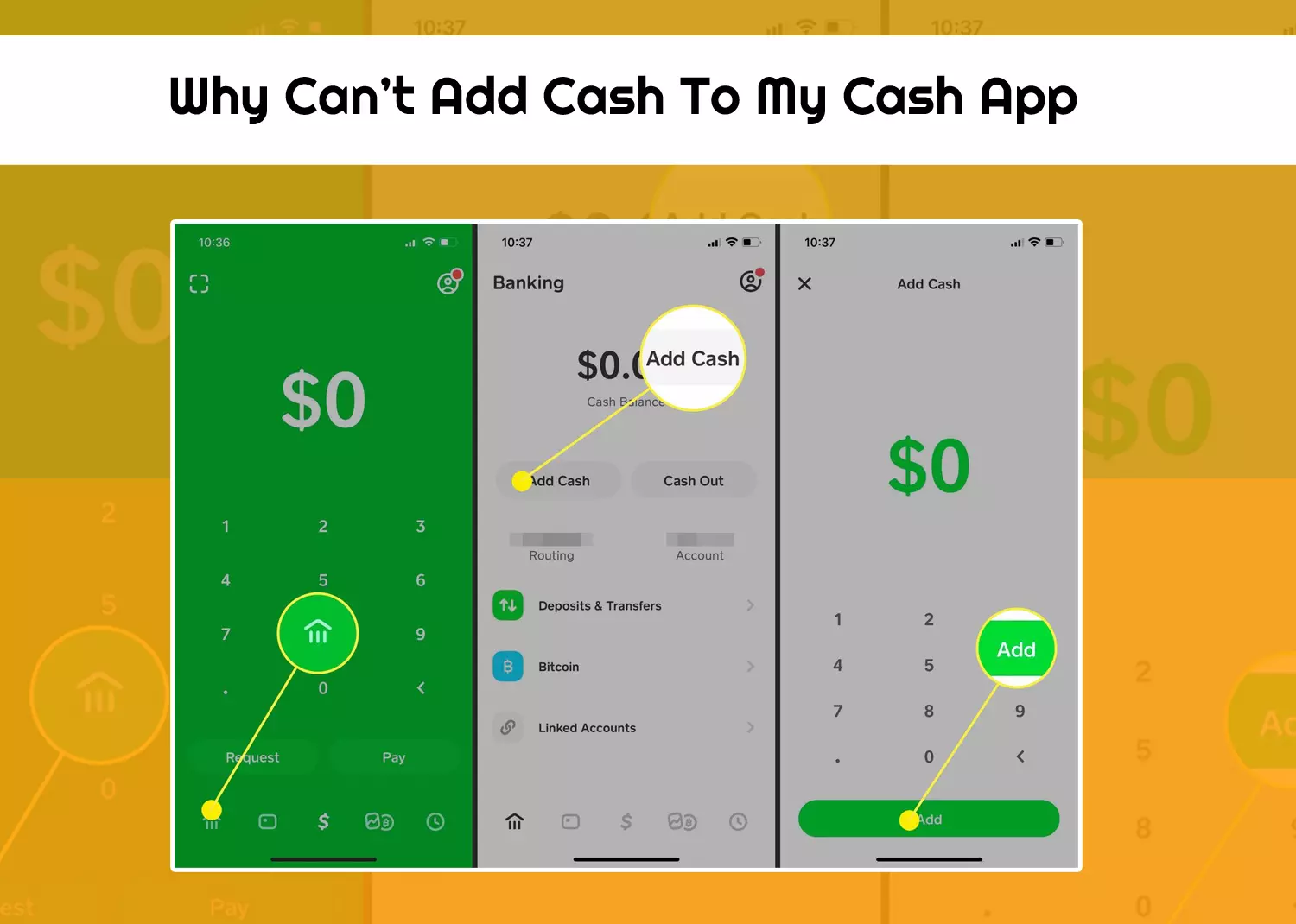

Read Also: Why can’t add cash to my cash app