October 20, 2021

346 Views

How to Enable Cash App Direct Deposit | A Complete Guide

Cash App has become a go-to personal banking app for most people in the United States. It offers various valuable functions, out of which the direct deposit feature is a prominent one. The Cash App direct deposit is a method through which payers send funds digitally to the payee’s account.

On turning on this feature, you can receive the Cash App direct deposit 2 days early. This feature also allows you to receive money from your employer in a hassle-free manner. Simply ensure to meet specific requirements to make your direct deposit fully accessible.

In this write-up, we’ll go into detail about the workings of direct deposit on the Cash App. You’ll find out when it hits and how to configure it.

The Working of the Direct Deposit Feature on Your Cash App

Direct deposit is a way by which the payer transfers funds straight to another user’s account. You can deposit tax returns, and paychecks, among other things, via your routing and account number to your Cash App balance. The recipient can get an amount of up to $25,000 in a single deposit made in this way.

In a single day or 24 hours, the receiver can get up to $50,000. Although the Cash App makes the deposits available to the recipient speedily, the first deposit may take some time. You can configure direct deposit to get your salary every month.

The app has no stringent conditions to make direct deposit accessible to users. All you require is to meet some basic parameters. These are described comprehensively in the next sections.

How to Set Up Cash App Direct Deposit

Setting up this feature on the Cash App requires you to adhere to some requirements. These include the following points.

- Your Cash App Card must be active.

- Your age must be 18 or above.

- The Cash App account you have must be verified.

- Only permanent US residents can set up a direct deposit.

- Your account shouldn’t have any track record of fraudulent activities.

- You must know the bank name for Cash App direct deposit and the routing number.

Find Your Routing Number and Cash App Direct Deposit Bank Name

Begin by finding out the bank name and the routing number of the Cash App. Follow these points to know these details.

- On your phone, launch the Cash App.

- Now, hit the ‘$’ symbol. It is at the bottom-left part of the Cash App screen.

- After that, tap the ‘Cash’ button.

- Head to ‘Direct Deposit.’

- Next, tap ‘Get account number.’

- You can now copy both account and routing numbers.

- With regards to the bank name, Cash App generally partners with Sutton Bank to issue the Cash App Cash Card for users.

- You can find out the bank name by going to the ‘Banking’ tab.

- Here, under your balance, hit the routing and account number.

4 Steps to Enable the Cash App Direct Deposit

This procedure involves ordering your Cash Card, activating it, enabling the direct deposit, and finally setting it up.

1. Order the Cash App card

- Sign into your Cash App account.

- From the app’s home screen, hit the ‘Cash Card’ tab.

- Now, click ‘Get Cash Card’ followed by ‘Continue.’

- Adhere to the guidelines on the screen.

- You will get your card within ten days from the order day.

2. Do the Cash Card Activation

- Sign in to the Cash App.

- Now click the photo of the Cash Card on the home screen.

- After that, click ‘Activate Cash Card.’

- In case you have the QR code of the Cash Card, give Cash App permission to use your device’s camera and scan the code.

- Click the ‘Use CVV instead’ option if you don’t have the QR code.

- Input the expiration date and the CVV code of your Cash Card.

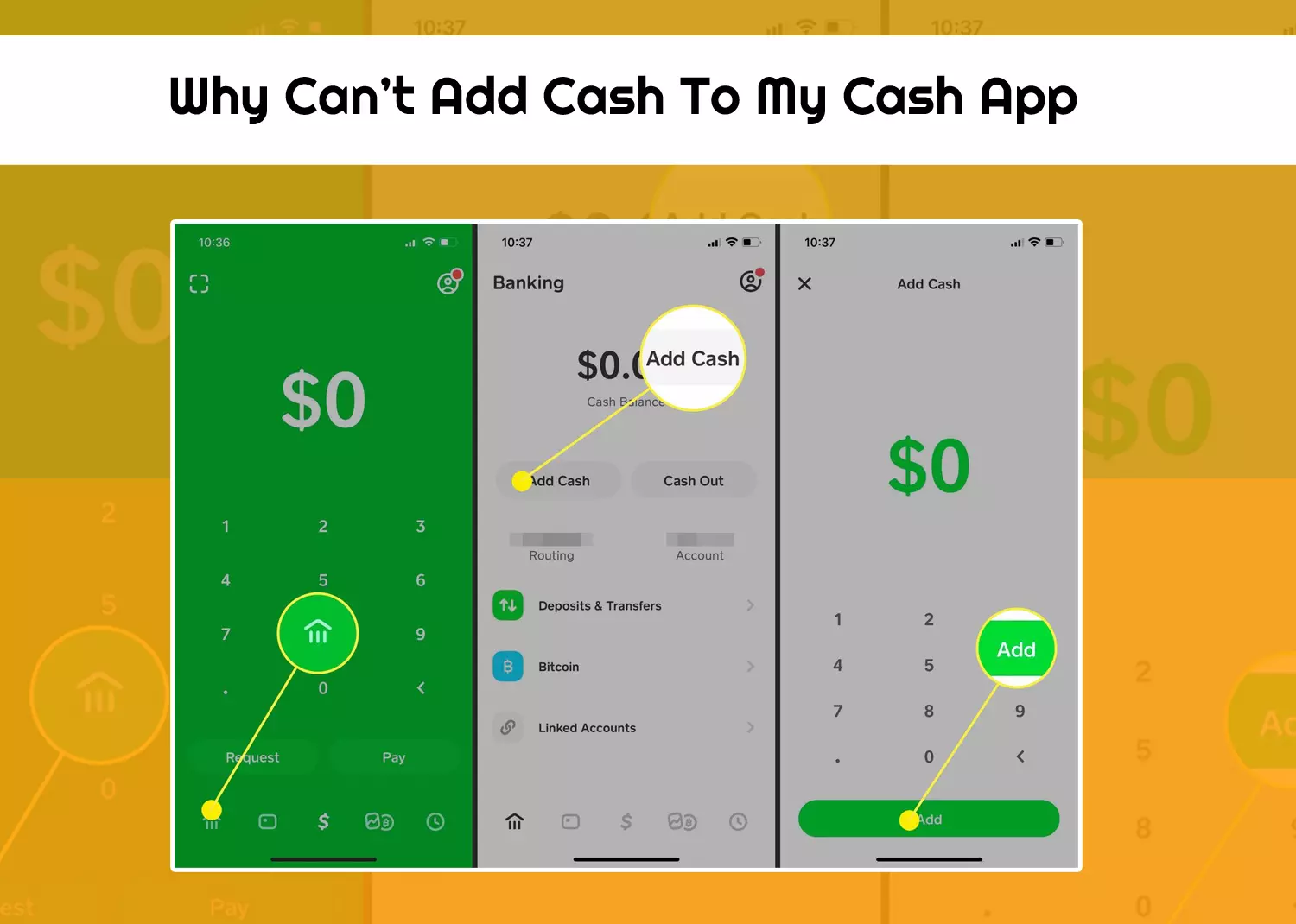

3. Enable your direct deposit on the Cash App

- Click the ‘Banking/Money’ tab on the Cash App’s home screen.

- Find your account and routing numbers under your balance.

- Click on the numbers so they get copied, and place them somewhere safe on your phone.

- Review the terms of the direct deposit and accept them.

- Finally, hit ‘Enable direct deposit.’

4. Set up your direct deposit

- Click the ‘Banking/Money’ tab on the home screen of the app.

- Now tap ‘Direct Deposit.’

- After that, tap ‘Get Started.’

- Find your employer.

- Adhere to the directions to finish the process.

What Time Does the Cash App Direct Deposit Hit?

Many users wonder about the Cash App direct deposit time or when they become available. The timing of the Cash App direct deposit differs based on when the direct deposits are submitted.

Generally, you will get money after 1 to 5 business days. However, if you find that your Cash App direct deposit is late, contact the Cash App support team. Apart from that, some other reasons for late direct deposits can be mistakes in the data you gave, account issues, or a delay in processing payment.

As per your bank and the time of the day, you can expect around one day for the funds to come into your bank account. If you are wondering what time of the day the Cash App direct deposit hit, it is between 2 AM and 4 PM in the time zone of the receiver.

In case you are expecting a deposit on a weekday, like Monday, it may arrive between 2 AM and 4 AM in your time zone.

Does Cash App direct deposit Come early

One of the advantages of using the direct deposit features in the Cash App is that it makes available direct deposits the moment they are received. The deposits are available around two days earlier compared to traditional banks.

If your employer is using direct deposit through Cash App correctly using your unique routing and account number, you can easily get your paychecks two days early.

Cash App Direct Deposit Failed Problem

One of the prevalent Cash App direct deposit issues is the user’s direct deposit failing. Some common reasons for this can be the amount of your deposit being above $10,000 on a specific day.

Sometimes, the Cash App servers don’t work, which causes the direct deposit to fail. If your Cash App is not updated, this problem can arise. Incorrect routing or account number is another reason for this direct deposit issue on the Cash App.

Summing up

Hopefully, now you are considerably familiar with the direct deposit feature on the Cash App. You also know when the Cash App direct deposit hit. Ensure to activate your Cash Card in order to enable direct deposit. To learn more about the various functionalities and capabilities of the app, visit amiytech.com.